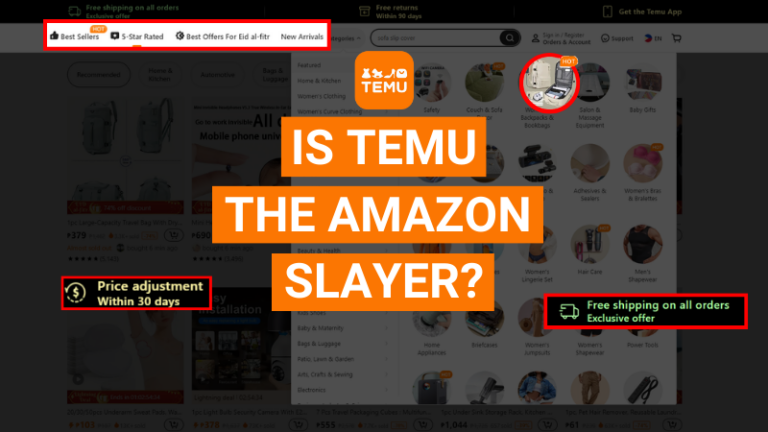

Is Temu The Amazon Slayer?

While Temu is a new platform for US shoppers, it is huge in China. It rose from nothing to competing head-to-head with Ali Baba and AliExpress in just a few years.

While Temu is a new platform for US shoppers, it is huge in China. It rose from nothing to competing head-to-head with Ali Baba and AliExpress in just a few years.

Get valuable, impactful and expert Amazon news and tips directly in your inbox with our newsletter.

As the holiday cheer fills the air, we at eGrowth Partners are bursting with excitement to share a momentous achievement that is sure to warm the hearts of Amazon sellers everywhere: a perfect 100% reinstatement rate for every single appeals case we submitted to Amazon in 2023!

As we bid farewell to another incredible year, it is time to unwrap the memories, achievements, and shared experiences that have made 2023 truly exceptional for our eGrowth Partners family. Grab a cup of coffee, get cozy, and let us embark on a journey through the highlights of our remarkable year together!

In the dynamic realm of e-commerce, Amazon sellers grapple with the ongoing challenge of efficient task management to thrive in the competitive marketplace. Addressing this, eGrowth Partners introduces a groundbreaking project management tool tailored for Amazon sellers.

As the holiday season approaches, sellers worldwide prepare for their busiest time of the year. With millions of orders to process and deliver, it is no surprise that things get hectic, and thanks to the efforts of our dedicated eGrowth Partners (EGP) Team, this year was no exception.

In the ever-expanding world of e-commerce, keeping your products visible, up-to-date, and well-organized on Amazon can be a daunting task. But what if there was a game-changing solution on the horizon that could revolutionize the way you manage your Amazon listings?

In the ever-evolving world of e-commerce, Amazon stands as a global giant. With millions of sellers, the platform thrives on seamless communication between sellers and customers.

© Copyright 2020. All Rights Reserved. eGrowth Partners. | Terms of Service | Privacy Policy | Disclaimer