Amazon recently announced that it will be enforcing its long-held requirement for sellers on its platforms worldwide to have liability insurance. Ever since I started selling on Amazon in 2010, sellers with over $10K/month in sales have been required to have product liability insurance. However, Amazon didn’t do much more than send sellers some emails with a link to upload their documents.

In light of recent lawsuits that held Amazon liable for products sold on their platform, Amazon is cracking down. There’s good news and bad news in this announcement for sellers:

Good News About Amazon’s Seller Insurance Requirements

- Amazon will cover all claims of $1,000 or less for sellers with no penalty to sellers.

- Amazon has provided a list of approved carriers and an international insurance broker (Marsh) to help sellers find the right insurance for their businesses.

- The right insurance will cover you on all the other platforms you sell on (including your own website).

Bad News About Amazon’s New Insurance Requirements

- Most sellers must comply by September 1, 2021, which isn’t a lot of time.

- Sellers who are normally under the $10K per month threshold may be required to get insurance.

- Foreign-based sellers must purchase in their local country and have a global protection policy.

- Amazon must be added as an additional insured and notified if the policy is cancelled or expires – this is not typical with most carriers.

- Your insured name must match the “legal entity” name you provided to Amazon which could be expensive or complicated for entities with multiple names and unusual structures (like holding companies) who own the business.

- Amazon sellers are on the hook for claims above $1,000 which are usually quite large because they are often lawsuits. $1M in coverage may not be enough to protect you.

Frequently Asked Questions About Amazon’s Enforcement of its Insurance Policies

Some sellers have been taken by surprise by this news. They either didn’t realize they were required to have insurance or thought they were exempt because they are not based in the United States. Here are answers to some of the questions we are seeing from our Amazon seller clients:

Q: I usually don’t sell more than $10K a month except during Q4. Do I need insurance?

Yes. Once you hit that threshold you must provide insurance to Amazon.

Q: My current carriers don’t notify “additional insureds.” Will Amazon enforce on this requirement?

I am confident they will. This is a crucial part of their new policy because sellers have been known to get insurance and then not renew it or get it and cancel it because they don’t want the expense. Amazon needs its sellers able to handle the bigger lawsuits that are over $1,000. According to Amazon’s numbers, 80% of claims are less than $1,000. They will cover these for us if our insurance covers the big lawsuits.

As to whether Amazon will suspend sellers, I don’t know. Amazon account suspensions tend to be their go-to punishment. They do have other options, however. They may choose to withhold disbursements, for example.

Q: I’m based in another country; how do I get the insurance Amazon requires?

You would get your insurance in your local country and make sure it has a global product liability rider. Your provider must have global claim handling capability and an “A” rating from S&P and/or AM Best or better. A local equivalent is allowed if those ratings aren’t valid in your country.

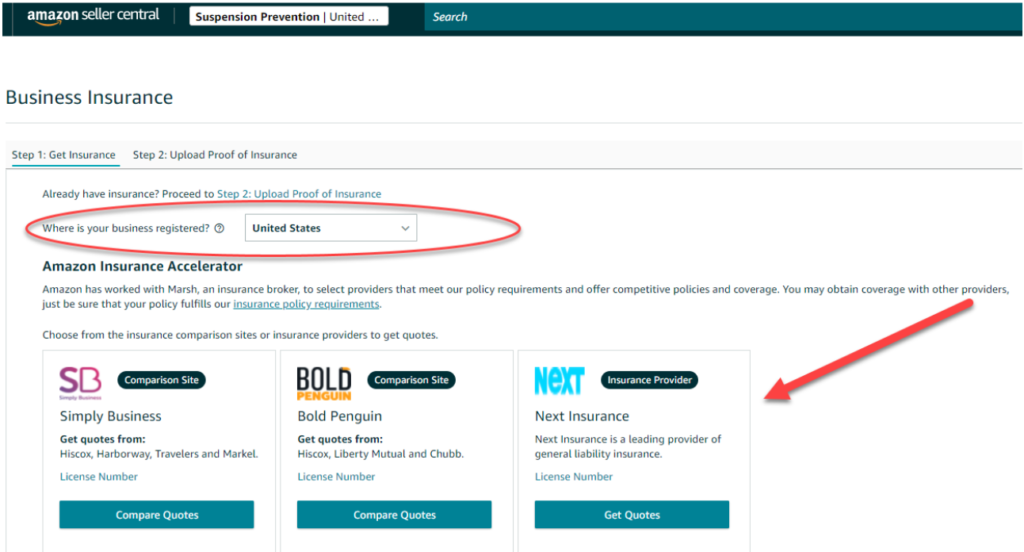

Q: Does Amazon have pre-qualified insurance carriers?

Yes. You can find a list HERE or you can contact Marsh. Marsh is a global insurance broker that has pre-identified carriers for Amazon and can help sellers worldwide, not just the US.

Q: What are Amazon’s insurance requirements?

You can also read these requirements in Seller Central under “Business Insurance.” Your commercial liability insurance policy must meet all of the following criteria:

- The policy limit must be at least $1 million per occurrence and in aggregate and cover liabilities caused by or occurring in conjunction with your business operations, including products, products/completed operations, and bodily injury;

- The insurance policy type can be either commercial general, umbrella, or excess liability and be occurrence based;

- Your insurance provider must have global claim handling capability and a financial rating of S&P A- and/or AM Best A- or better (if S&P or AM best is not valid or used in the country where you are required to obtain insurance, a local equivalent is allowed);

- Your insurance provider must give Amazon at least 30 days’ notice of cancellation, modification or nonrenewal;

- The policy must name “Amazon.com Services LLC and its affiliates and assignees” as additional insureds;

- The deductible for any policy(ies) must not be greater than $10,000 and any deductible amount must be listed on the certificate(s) of insurance;

- The policy must cover all sales from products you have listed on the Amazon website;

- Your insured name must match the “legal entity” name you provided to Amazon;

- The policy must be completed in its entirety and signed; and

- The policy must be valid for at least 60 days from the date of submission.

Q: My insured name doesn’t match the legal entity name I provided to Amazon when I set up my account. Is that a problem?

You will need to get insurance in the same name/legal entity that was used to set up your seller account. Here are your options:

- Update your seller account information if it is out of date. This assumes the tax ID is the same and you are adding/changing a DBA. Please note, your storefront name is NOT your legal entity. You may have set it up that way, but Amazon sees them as separate so make sure it is your legal entity you are looking at.

- Get new insurance under your legal entity name.

- Update your entire seller account to reflect your current operations.

This may require some thought and caution to avoid an account suspension if there has been an ownership change or if you have multiple accounts.

Q: I already have a certificate of insurance registered with Amazon, I’m OK right?

That depends. You should review your policy now to make sure it meets all of Amazon’s new requirements, including the 30 days’ notification of cancellation, modification or nonrenewal to Amazon. Additionally, make sure your policy has a deductible $10K or less and goes up to at least $1 million per claim. Depending on when you got your insurance, it may not cover you in all your current marketplaces.

Q: I have multiple brands/seller accounts on Amazon, all held under the same corporate umbrella. Do I need multiple insurance policies?

No. One policy that covers all your inventory should be OK. You may need to upload it through each seller central account, however, and you should list the brands as well as the corporation on the certificate of insurance.

Q: I have multiple seller accounts that Amazon doesn’t know about. I don’t want Amazon to become aware that all these accounts are owned by the same person/entity. What do I do?

This is a tricky one. What is really being asked here is, “Will Amazon link my accounts?” Obviously, the seller can get insurance under the different entities, but some sellers have taken over someone else’s account and are unable to legally buy insurance for that entity because it no longer exists or is a phantom to begin with.

First, Amazon might link the accounts. They certainly have the capability to do so. Whether they will search the insurance documents for linked accounts I have no idea at this time.

Second, some sellers set up “Plan B” or “Stealth” accounts as a risk management hedge. Many of these were set up a long time ago before Amazon started verifying accounts, generally making it hard for sellers to get insurance coverage without forged documents and lying. Now these accounts are a real problem because Amazon will take them all down if they link them.

For sellers looking to clean up their portfolio and get compliant with Amazon’s policies, we are here to help:

Q: I’m a reseller and not a brand. Do I need insurance?

Yes. For one thing, Amazon requires it. For another, you are not immune from being sued. An unhappy/injured buyer will sue everyone they can find to get redress for their problem. While the court may ultimately agree that you are not liable for a manufacturing defect, that could be after you’ve spent $100K+ in legal fees. The courts recently agreed that Amazon was liable for selling dangerous products on its platform. You don’t think they are going to take the hit alone do you? No! They will claim you are also liable for selling a dangerous/faulty product.

Q: Why isn’t Amazon accepting my proof of insurance?

There are several common reasons for this. You may be trying to upload your quote rather than the certificate of insurance (COI). A COI is issued after you’ve paid for your insurance and has a specific policy number on it.

Alternatively, your carrier may not be an “A” carrier. You are required to use a carrier with an “A” rating with Standards & Poor or AM Best – a major carrier in other words.

Your insurance may not meet all of Amazon’s requirements like notifying Amazon within 30 days of cancellation or perhaps your deductible is too high. Compare your policy carefully to Amazon’s requirements.

Your legal name on the certificate of insurance may not match the legal entity Amazon has on file for you.

The format of your file may not be one that Amazon accepts. Make sure it is a PDF, DOCX or DOC. It also cannot be larger than 50 MB.

Q: Amazon isn’t actually going to read my policy, is it? I don’t want them to know so much about my business.

Define “read.” I’m confident every policy will be scanned by machine learning robots looking for compliance. Have you ever read a deposition in a lawsuit? Every single word is indexed in the back. I imagine Amazon will be doing that to seller policies to make it easier for them in case there is a claim larger than $1,000. They can quickly find whatever information they need in your extremely long policy.

So, read? No. Can they find out a lot about you if they want to? Absolutely, but they already know you far better than you are comfortable with. Just saying.

Q: All I need is $1M liability policy, right?

Maybe. You should discuss your needs with your broker and/or carrier thoroughly. There are a lot of factors that go into risk assessment. What you sell, where you sell, how it is stored and shipped are just the beginning. Many sellers don’t realize that their insurance policy might provide them with less-expensive shipping protection than they are getting from UPS/Fedex, for example. If you are selling on other platforms like Walmart, eBay or on your own website, you need to be protected for there as well – not just Amazon. If you own a warehouse, then your needs and risks are different than someone who ships everything directly to Amazon. $1M is the minimum Amazon requires. It doesn’t mean you will be completely protected in a product liability lawsuit.

Final Thoughts

This discussion is about product liability insurance requirements for Amazon. Whatever policy you buy won’t necessarily cover you for injuries in the workplace, theft, damaged inventory or accidents with your truck fleet. Be thorough and thoughtful about what you need. Despite Amazon being the one pushing for proof of insurance, the business you save will be your own.